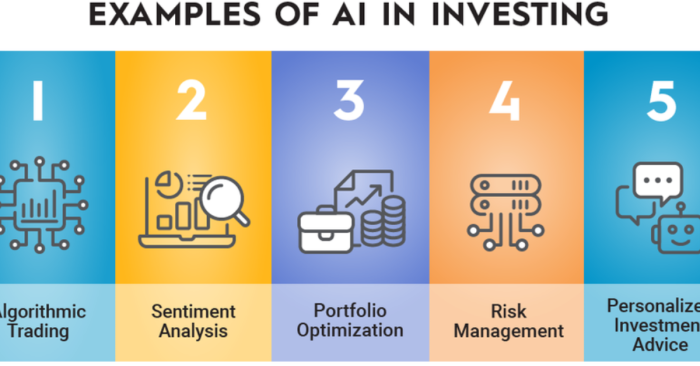

AI Tools for Investors

Artificial Intelligence (AI) is transforming the way investors analyze markets, manage portfolios, and make financial decisions. By leveraging AI-driven tools, investors gain access to real-time insights, predictive analytics, and smarter investment strategies. These tools not only save time but also minimize risks and maximize returns. Below, we explore the top ways AI tools empower investors today.

1. AI-Powered Stock Screeners

AI stock screeners allow investors to filter stocks based on price movements, financial health, growth potential, and technical indicators. Unlike traditional screeners, AI adds predictive capabilities, helping investors identify opportunities early.

2. Predictive Market Analytics

AI uses historical data and real-time market signals to forecast potential price trends. These predictive models are especially useful for spotting market volatility, giving investors an edge.

3. Portfolio Optimization Tools

AI helps investors build diversified portfolios that balance risk and reward. These tools suggest asset allocation strategies that adapt to changing market conditions.

4. Robo-Advisors

Robo-advisors powered by AI provide automated investment guidance tailored to individual risk profiles. They continuously rebalance portfolios and ensure long-term growth.

5. Sentiment Analysis Platforms

AI scans news articles, financial reports, and social media trends to evaluate market sentiment. Investors can use this data to anticipate market reactions.

6. Risk Management Systems

AI detects potential financial risks before they escalate. From credit risk to portfolio risk, these systems provide alerts to safeguard investor capital.

7. AI-Driven Trading Bots

Trading bots use algorithms and machine learning to execute trades automatically. They analyze patterns and make decisions in milliseconds, reducing emotional trading errors.

8. Alternative Data Analysis

AI processes non-traditional data such as satellite images, weather reports, and consumer activity to provide unique investment insights. This gives investors a competitive advantage.

9. Fraud Detection Tools

AI systems monitor transactions and flag unusual activities. This adds an extra layer of security for investors, especially in online trading.

10. Personalized Investment Assistants

AI chatbots and assistants offer personalized guidance, answer investment queries, and provide round-the-clock support for investors.

(FAQs)

What is the role of AI in investing?

AI assists investors by providing data-driven insights, predictive analytics, and automated portfolio management to improve decision-making.

Are AI tools better than human advisors?

AI tools provide fast, accurate insights and automation. However, combining AI with human expertise often yields the best results.

Can beginners use AI investment tools?

Yes, many AI-powered platforms are user-friendly and designed for beginners, offering robo-advisors and guided investment strategies.

Learn More About AI Course https://buhave.com/courses/learn/ai