The Certified Public Accountant (CPA) credential is a highly respected and widely recognized professional accounting designation granted by the American Institute of Certified Public Accountants (AICPA) in the United States.

To earn the CPA credential, individuals must meet specific educational and experience requirements and pass a rigorous four-part exam. The exam covers a range of accounting and business-related topics, including auditing, financial reporting, taxation, and ethics.

The CPA credential is essential in accounting because it signifies high expertise, knowledge, and professionalism. A strict code of ethics binds CPAs. They are required to engage in continuing education to maintain their certification.

CPA Credential Evaluation For International Accountants US

International students and professionals who wish to obtain the CPA credential in the US will need to complete an evaluation process to determine if their education and experience meet the requirements of the state where they wish to become licensed.

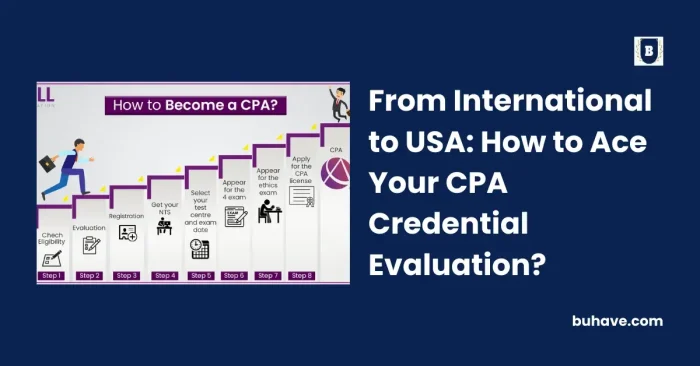

The process generally involves the following steps:

- Determine the requirements

- Get foreign transcript evaluation for CPA

- Meet experience requirements

- Take the CPA exam

- Apply for licensure

It is important to note that the evaluation process for international students and professionals can be complex and time-consuming. It is recommended to work with a CPA licensing agency or a credential evaluation service that will help you in navigating CPA requirements to ensure that the process goes smoothly.

Understanding the CPA Credential Evaluation Process

Suppose you have completed any academic coursework outside of the United States. In that case, those courses are considered “international” or “non-domestic.” As a result, you will need to go through a foreign credential evaluation process if any of your education hours were obtained through international courses.

This evaluation ensures that those credits are equivalent to US-based education credits and that obtaining a Certified Public Accountant (CPA) credential in the United States is necessary.

The CPA Requirements For International Accountants US

International students and professionals who want to become CPAs in the US must meet the same qualifying standards as domestic applicants.

However, suppose you completed academic credits outside of the US. In that case, you’ll need to have your qualifications verified by a National Association of Credentials Evaluation Services (NACES) member.

To become a CPA in the USA, you’ll need to follow these steps:

- Choose a US jurisdiction where you want to practice and apply for a CPA license.

- Contact the Board of Accountancy in your jurisdiction to learn about their requirements.

- Find out what foreign credential agencies your jurisdiction uses. Check with your state’s accountancy board for the latest information.

- Pick an agency and learn what documents you must submit for your evaluation. These may include original transcripts, a copy of your ID or passport, and an English translation of non-English documents.

- Submit your CPA USA application and pay the required fee.

- The agency will assess your education and college courses to determine if they are equivalent to ones in the United States.

- The credential evaluation agency will send a report to your state board.

- Your state board will contact you with their findings. You can apply for the CPA Exam if your international education meets their standards. They will let you know if you need more college credits.

- Schedule your CPA Exam after your application has been accepted.

- Within 18 months, complete all CPA USA requirements and pass all four mandatory CPA exam sections.

- Once you’ve met all the licensure criteria, you can apply for your CPA license.

Remember to follow the specific requirements of your chosen jurisdiction and work with a NACES member to have your international academic credits verified.

Here are some tips for successfully navigating the CPA credential evaluation process:

Start early:

The evaluation process can take several weeks or even months, so beginning as soon as possible is vital. This will ensure you have enough time to gather all the necessary documents and information.

Research the requirements:

Each state has specific requirements for CPA licensure, so it’s essential to research and understand the requirements of the state you want to practice in. This will help you ensure you have all the necessary documents and qualifications before submitting your application.

Choose a reputable evaluation service:

Make sure your evaluation service is a member of NACES. This will ensure that your evaluation is completed accurately and on time.

Gather all necessary documents:

Make sure to gather all the required documents, such as transcripts, diplomas, and translations, before submitting your evaluation request. This will help ensure that the process runs smoothly without delays.

Follow up regularly:

Once you have submitted your evaluation request, it’s essential to follow up regularly to ensure the process progresses smoothly. This can include contacting the evaluation service, as well as the state board of accountancy, to check on the status of your evaluation.

Be patient:

The evaluation process can take some time, so it’s essential to be patient and understand that it may take several weeks or even months to receive your evaluation report. Plan and give yourself ample time to complete the evaluation process before applying for the CPA exam or licensure.

By following these tips, you can successfully navigate the CPA credential evaluation process and ensure you have all the qualifications to become a licensed CPA in the United States.

In Conclusion

Navigating CPA requirements can be a daunting task for international students and professionals. However, by following the steps outlined in this guide and being diligent, you can successfully ace your evaluation and fulfill the requirements to become a licensed CPA in the United States.

– If you are looking for a guest post, write for us education article now.